- Commissioner’s statement on Ventura, Marte

- Ronnie O’Sullivan: Masters champion ‘felt so vulnerable’ in final

- Arron Fletcher Wins 2017 WSOP International Circuit Marrakech Main Event ($140,224)

- Smith challenges Warner to go big in India

- Moncada No. 1 on MLB Pipeline’s Top 10 2B Prospects list

- Braves land 2 on MLB Pipeline’s Top 10 2B Prospects list

- Kingery makes MLB Pipeline’s Top 10 2B Prospects list

- New Zealand wrap up 2-0 after Bangladesh implosion

- Mathews, Pradeep, Gunathilaka to return to Sri Lanka

- Elliott hopes for rain for Poli

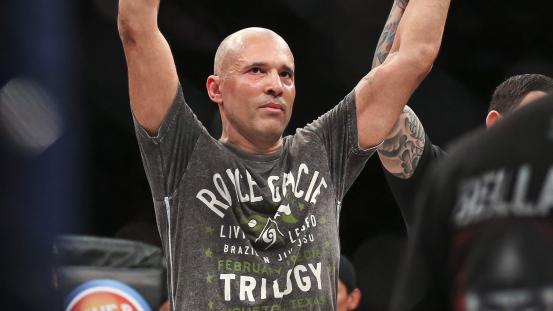

IRS: Royce Gracie’s company fraudulently failed to report over $1.4 million in income

- Updated: May 11, 2016

In January, Bloody Elbow broke the news of Royce Gracie’s tax battle with the IRS over the agency’s determination that he and his wife fraudulently evaded paying over $1.1 million in personal income taxes from 2007-2012 through the use of foreign bank accounts, wire transfers “used to pay for, among other things, renovations to their vacation property in Mammoth lakes, California, and personal credit card debts,” hiding corporate income as “personal loans,” and other means.

Bloody Elbow’s original story reported numbers excluding credits, writing that as a result of the Gracies’ alleged conduct they “appear to have reported annual tax liabilities of just $900, $2,545, $170, $0, $0, and $3,925 in 2007-2012.” Bloody Elbow’s tax expert believes that once credits the Gracies allegedly claimed such as the Earned Income Credit (a tax credit for the working poor) and Additional Child Tax Credit are included in the numbers above for 2008-2012, the situation looks even worse.

According to Bloody Elbow’s tax expert, the Gracies’ reported net tax liability after credits for 2008-2012 appears to be negative, meaning they effectively (and allegedly) asked the U.S. government to pay them instead of the other way around. To be more precise, Royce Gracie and his wife allegedly asked the U.S. government to pay their family a total of $13,440 over the five-year period from 2008-2012, according to our expert. That means someone who paid just $1 in federal taxes during 2008-2012, would’ve effectively paid thousands more to the U.S. government than the Gracies allegedly did during the same time frame.

If all this is true, it’s bad enough to ask the government to pay you when you’re a world-famous UFC Hall of Fame fighter with 55 Royce Gracie Jiu-Jitsu Networks across the globe and a wife who’s a doctor of podiatric medicine, but Bloody Elbow recently discovered that the IRS also made two separate tax deficiency determinations against Gracie and his wife’s company, Khonkhor Enterprises, one claiming negligence-related tax penalties, the other claiming both fraud and delinquency-related tax penalties.

In 2013, the IRS sent Khonkhor a Notice of Deficiency with a determination that the company owed an additional $76,755 in taxes for Khonkhor’s fiscal year ended Mar. 31, 2010 plus a 20% penalty ($15,351) that was coded “Accuracy-related (Negligence).”

According to the Notice of Deficiency, the IRS determined that $11,325 in meals and entertainment expenses, $52,532 in travel expenses, $65,020 in office supplies expenses, and $10,048 in interest expenses “have not been shown to be an ordinary and necessary expense of [Khonkhor]. [Khonkhor] failed to substantiate 1) that the expenditures are deductible…or 2) that the expenditures were incurred for the purpose designated.”

The deficiency notice also included adjustments for an unexplained $50,000 deposit in Malaga Bank, $77,753.97 in unexplained credit card payments, a $25,000 wire transfer from HSBC in Geneva, Switzerland, and a $10,000 wire transfer from Deutsche Bank in Beijing, China.

Based on all the determinations above, the IRS increased Khonkhor’s taxable income through Mar. 31, 2010 by $219,229, resulting in $76,755 additional tax owed plus a 20% accuracy-related penalty due to what the IRS claimed was Khonkhor’s negligence or disregard for the rules and regulations.

Then in 2015, the IRS sent Khonkhor another Notice of Deficiency, this …

continue reading in source www.bloodyelbow.com